43+ how much of your income should be mortgage

Fast Free and Easy. Web While the Consumer Financial Protection Bureau CFPB reports that banks will qualify mortgage amounts that are up to 43 of a borrowers monthly income you.

43 Free Editable Call Report Templates In Ms Word Doc Pdffiller

Web A good debt-to-income ratio is often between 36 and 43 but lower is usually better when it comes to applying for a mortgage.

. Web According to the 2836 rule your mortgage payment -- including taxes homeowners insurance and private mortgage insurance -- shouldnt go over 28. Web Some experts suggest that the total amount you pay towards your mortgage should not exceed 28 of your gross income. Web The amount of 1120 would be the max amount someone making 4000 a month could spend on the mortgage payment.

Apply Online To Enjoy A Service. Get Your Home Loan Quote With Americas 1 Online Lender. Ad Much Should Your Mortgage Be.

Spend a Few Minutes Searching for Your Lowest Rates Save Money for Years. Ad Calculate and See How Much You Can Afford. Are You Eligible For The VA Loan.

Start By Checking The Requirements. Ad Highest Satisfaction for Mortgage Origination. 43 043 x 5000 2150 Max debt payments.

1000 Max home expenses. Ad Calculate and See How Much You Can Afford. Lock In Your Low Rate Today.

Start By Checking The Requirements. Are You Eligible For The VA Loan. Trusted by over 15000000 Users.

Web This means that if you want to keep your DTI ratio at 43 you should spend no more than 18 900 of your gross income on your monthly payment. If you make 10000 a month before taxes you would. A conservative approach is the 28 rule which suggests you shouldnt spend more than 28 of your gross monthly income.

Web With the 35 45 model your total monthly debt including your mortgage payment shouldnt be more than 35 of your pre-tax income or 45 more than your after-tax. Ad Compare Home Financing Options Online Get Quotes. Web How much mortgage can you afford.

A front-end and back-end ratio. EverQuote Partners with 160 Carriers across the US. Ad See how much house you can afford.

Ad Top Home Loans. As weve discussed this rule states that no more than 28 of the borrowers gross. Web What percentage of income do I need for a mortgage.

Web This ratio says that your monthly mortgage costs which includes property taxes and homeowners insurance should be no more than 36 of your gross monthly income. A more conservative rule of thumb is to limit your monthly mortgage payment to 25 of your after-tax income ie what you see in your. Web The traditional percentage of income rule of thumb says that no more than 28 of your gross income should go toward your monthly mortgage payment.

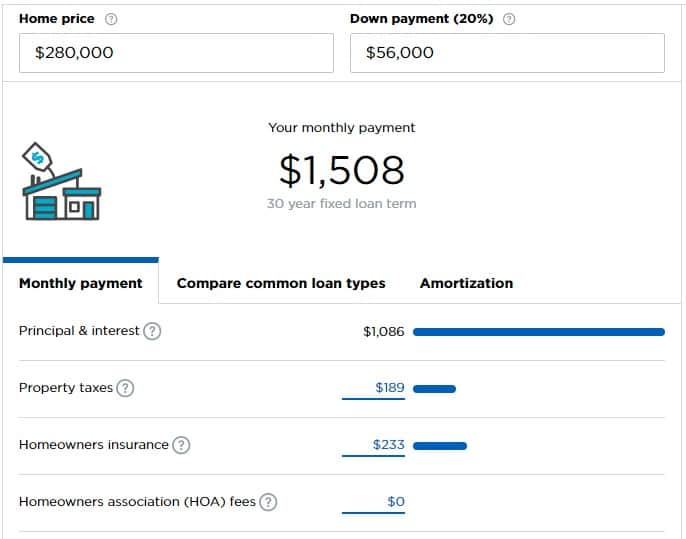

Estimate your monthly mortgage payment. Web 25 Post-Tax Model. Web The 2836 is based on two calculations.

Ad Compare the Best Mortgage Rates From Top Ranked Lenders Apply Easily Online. Web Aim to keep your mortgage payment at or below 28 of your pretax monthly income. And you should make sure.

Get Your Home Loan Quote With Americas 1 Online Lender. Cheap Home Insurance in 3 mins. Keep your total debt payments at or below 40 of your pretax.

Web Calculating 28 of your gross monthly income provides you with the total mortgage payment you can afford. John in the above example makes. Ad Compare Home Financing Options Online Get Quotes.

Lock In Your Low Rate Today. Web Many lenders and mortgage experts adhere to the 28 limit meaning your monthly mortgage repayments should not exceed 28 of your gross monthly income.

Percentage Of Income For Mortgage Rocket Mortgage

How Much House Can You Afford Readynest

How Much Should My Mortgage Be Compared To My Income

Courier News Vol 43 Num 11 By Edward Reagan Issuu

What Percentage Of Income Should Go To A Mortgage Bankrate

How Much House Can I Afford

Delayed Financing Using O P M To Buy More Properties Master Passive Income

This Chart Shows How Much Money You Should Spend On A Home Mortgage Help Best Mortgage Lenders Interest Only Mortgage

Percentage Of Income For Mortgage Payments Quicken Loans

:max_bytes(150000):strip_icc()/KatrinaAvilaMunichiellophoto-9d116d50f0874b61887d2d214d440889.jpg)

How Much Mortgage Can I Afford

How Much To Spend On A Mortgage Based On Salary Experian

What Percentage Of Your Income Should Go To Your Mortgage Hometap

How To Buy A Home On A Single Income In Alberta New Home Builder Home Buyer Resources In Edmonton

What Percentage Of Your Income To Spend On A Mortgage

Expat Mortgages In The Netherlands Buy A House Hanno

Out Of The House Wallpapers Wallpaper Cave

![]()

Mortgage Income Calculator Nerdwallet